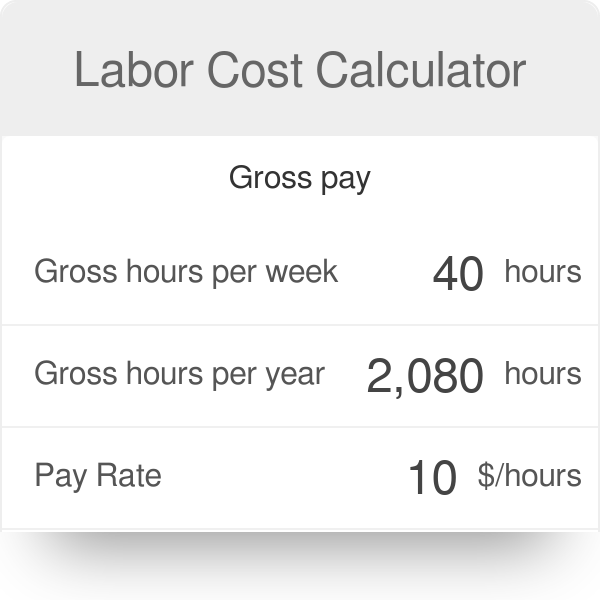

Compute the Standard Direct Labor Rate Per Hour

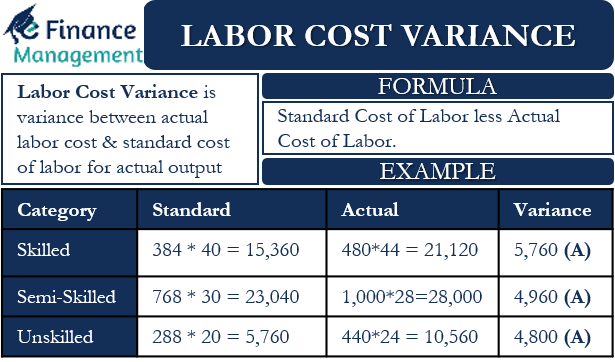

AH x SR 83000. Under both acts the regular rate or basic rate is 1300 an hour which includes the 100 per hour for the long-boom time.

Direct Labor Variances Example Youtube

Computation of standard direct labor rate per unit.

. A standard cost _____ indicates the amount of direct labor direct materials and overhead for one unit of product. The Fiscal Intermediary Standard System FISS is the standard Medicare Part A claims processing system. Actual direct labor hours worked x Predetermined overhead rate 281400.

This one hour rest or break is not included in computation of working hours. Each of its 10 helicopters makes between 1000 and 2000 round-trips per year. A _____ variance is the difference between the actual quantity per unit and the standard quantity per unit.

Compute the standard direct labor cost of the company if it produced 5000 units during the month of July 2022. Through its Direct Data Entry DDE system you may perform the following functions. Manufacturing overhead applied to products.

AH x AR 84000. The records indicate that a helicopter that has made 1000 round-trips in the year incurs an average operating cost of 350 per round-trip and one that has made 2000 round-trips in the year incurs an average operating cost of300 per round-trip. MSAL can modify these standard working hours on case to case basis.

Inquire about the status of claims. Enter correct adjust or cancel your Medicare billing transactions. Compute the labor rate variance.

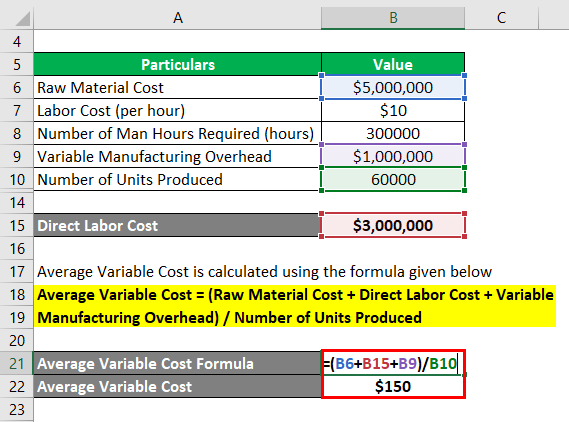

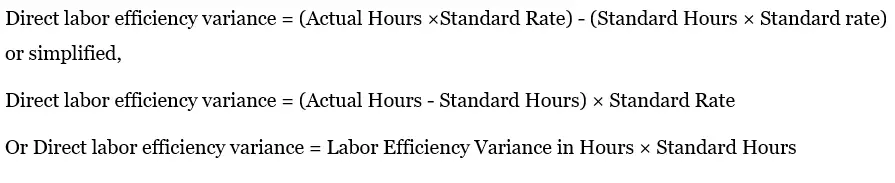

84000 - 83000 1000 Unfavorable. Standard direct labor per rate hour Standard direct labor time per unit 5 2 hours 10. A company has a favorable direct labor.

Card A manufacturing company accumulates the following data on variable overhead. Overtime rates are 125 times the basic hourly rate for excess hours worked on ordinary days 150 times the basic hourly rate for all hours worked on the weekly day off and twice the basic hourly. The estimated operating and cost data for three different companies is given below.

Estimated manufacturing overheadEstimated direct labor hours 67 per direct labor hours. Inquire about beneficiary eligibility. Quantity 17280 - 35000 x 05lb x 1 lb 220 Favorable.

Computation of standard direct labor cost to be applied to production. SH x SR 85000. An additional payment of not less than 650 an hour as extra compensation for weekly overtime is required for 5 of the 45 hours worked 5 650 3250 required overtime premium.

Actual allocation base times times the standard variable rate.

Fixed Overhead Standard Cost And Variances Accountingcoach

Average Variable Cost Formula Examples With Excel Template

What Is Direct Labor Efficiency Variance Accounting Hub

Comments

Post a Comment